Be a Confident Investor

An important feature of the Deferred Compensation Plan is that you get to decide how your savings are invested. This is valuable because it means you can choose your investments based on your personal circumstances and unique thoughts about achieving a comfortable retirement.

The kinds of investments you choose will largely depend on your personal risk tolerance. When you’re early in your career, or if you won’t need your DCP savings for a while, you may decide to invest more aggressively. But if you’re retiring soon, or will need to make a withdrawal soon, you may prefer a more conservative set of investments so that you don’t experience an unexpected decrease in your account balance.

You may find it intimidating to choose your investments. The DCP makes that decision easier for you by offering a simple, but robust, menu of professionally managed investment choices at a competitive cost. The investments offered by the DCP fall into three distinct categories:

Risk-Based Portfolio Funds

Core Funds

Self-Directed Brokerage Account

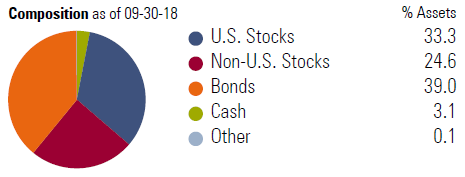

Risk-Based Portfolio Funds - The risk-based portfolio funds are the easiest to use. They are diversified portfolios designed to meet your desired risk level. A diversified portfolio is one that is made up of several different invest types—corporate and government bonds, U.S. and international stocks, and cash equivalent investments. Professional investment managers recommend a diversified portfolio so that you’re not “putting all your eggs in one basket.” Different asset classes tend to perform differently at different points in time, so diversification can help to smooth out volatility.

The DCP offers five risk-based portfolio funds from ultra-conservative through ultra-aggressive. The conservative portfolios are made up of more bonds, while the aggressive portfolios are made up of more stocks. Check out the charts below to see how each portfolio is designed:

Ultra-Conservative Portfolio

Conservative Portfolio

Moderate Portfolio

Aggressive Portfolio

Ultra-Aggressive Portfolio

The aggressive portfolios are considered riskier because stocks have greater volatility—that means their value is expected to fluctuate up and down more than bonds. Historically over the long-term, stocks tend to outperform bonds and cash. The aggressive portfolios are considered riskier because stocks have greater volatility—that means their value is expected to fluctuate up and down more than bonds, providing greater returns for the investor, although past performance is no guarantee of future results.

Core Funds - If you’re confident in your knowledge of the stock market and investment types, you may consider constructing your own custom portfolio using the DCP’s core funds. Each of the DCP’s core funds represents a major investment type (bonds, large cap stocks, international stocks, etc.) and are used to construct the risk-based portfolio funds. But you can also use these funds yourself to assemble your own portfolio. The core funds also include the Stable Value Fund and FDIC-Insured Savings Account which are investment options designed to maintain your principal while still providing a modest return.

Self-Directed Brokerage Account - For our most active investors, the DCP also offers you the Self-Directed Brokerage Account. This option provides participants with access to a variety of publicly traded mutual funds, equities, bonds, Exchange Traded Funds (ETFs), and Certificates of Deposit (CDs). This option is designed for investors who understand the risks and potential volatility involved with managing your own investments.

Last year was a volatile year for the markets. There were many up and downs. An important part of investing is to understand how much volatility you’re comfortable with in your retirement portfolio. In order to reach your personal retirement goals, you want to choose the risk and volatility level that works for you.

If you come across a term you’re not familiar with, check out our Investor Glossary. As always, the DCP is here to help you meet your retirement goals. If you have any questions about the DCP’s investment options, don’t hesitate to reach out!